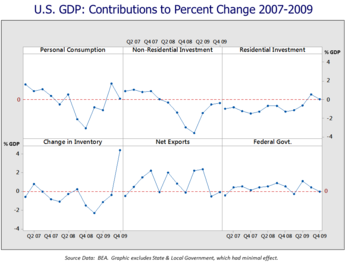

60+ banks lost money during the mortgage default crisis because

They held a mortgage-backed securities. The prime players were banks hedge funds investment.

Why I M Not Scared Of My Interest Only Mortgage Monevator

Web banks lost money during the mortgage default crisis because.

. Financial institutions decided to reduce their exposure to risk dramatically and banks hesitated to lend to each other. Web Banks and investors began losing money. During this crisis the lenders were the biggest culprits because they freely granted loans to people who could not.

Web - homebuyers defaulted on mortgages held by the banks. Web It seems that people who put deposits on the loans that were foreclosed upon lost their money not the banks. The banks just kept reselling the homes for more.

Of defaulted loans to investors in the mortgage-backed securities b. Web The ultimate cause of the subprime mortgage crisis boils down to human greed and failed wisdom. They held mortgage-backed securities they.

Web Banks lost money during the mortgage default crisis because. Web were community banks often in parts of the country where the subprime mortgage crisis and the recession made real estate problems more severe than elsewhere. Of defaulted loans to investors in mortgage-backed securitiesB.

How Banks Can Avoid A Repeat Of The 2008 Foreclosure Crisis

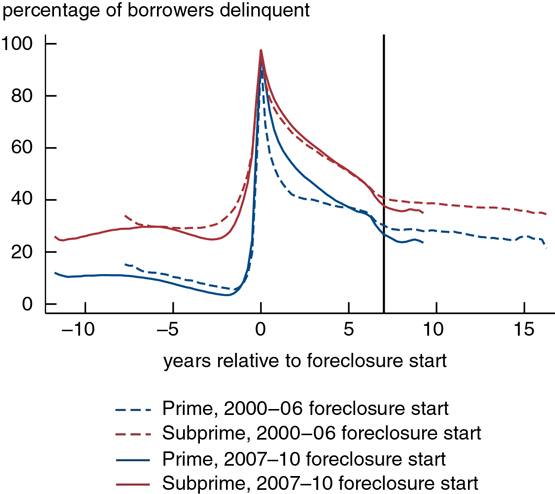

Have Borrowers Recovered From Foreclosures During The Great Recession Federal Reserve Bank Of Chicago

Alt A Option Arm And Subprime Loans Will Turn California Into A Zombie Mortgage State 28 Percent Of Alt A Loans In California 60 Days Late Alt A Mortgages By California Region 1 1 Million Alt A

How To Get A Mortgage 17 Tips To Boost Your Chances Mse

Nzd Definition Financial Dictionary Fxmag Com

Pdf Second Chances Subprime Mortgage Modification And Redefault Joseph Tracy Academia Edu

Subprime Mortgage Crisis Wikipedia

Foreclosure Delay And Consumer Credit Performance Springerprofessional De

The Fed Stopped Buying Mbs Today Wolf Street

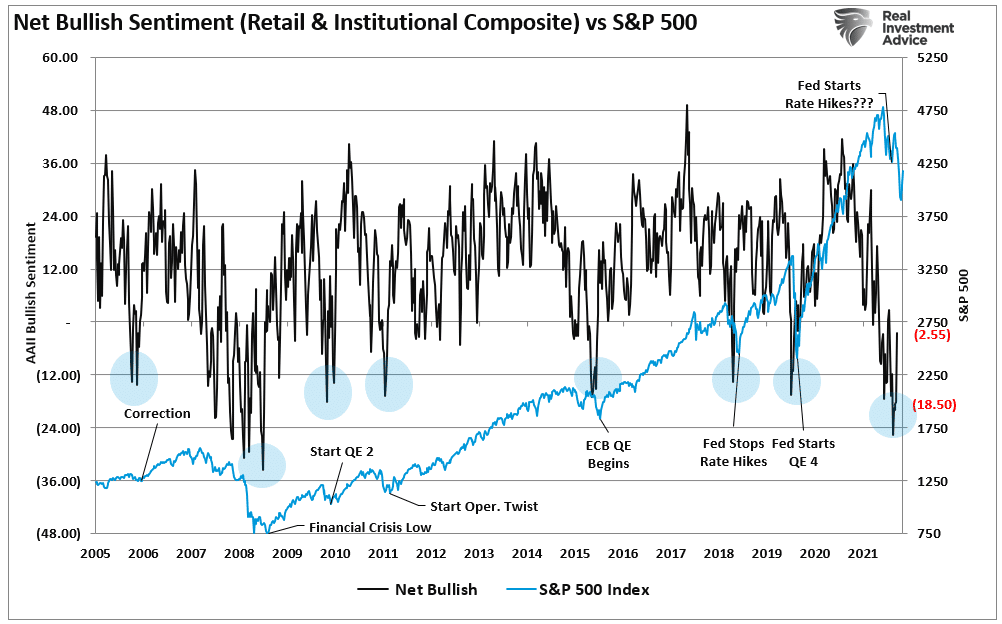

Investors Are Terrified So Why Aren T They Selling Seeking Alpha

Financial Crisis Creditor Debtor Conflict And Populism Gyongyosi 2022 The Journal Of Finance Wiley Online Library

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Treasury Rbnz Start Turning Their Attentions Towards Saving For The Next Rainy Day Interest Co Nz

Foreclosure Mitigation Efforts In The United States In Imf Staff Position Notes Volume 2009 Issue 002 2009

Subprime Mortgage Crisis Wikiwand

How To File Bankruptcy Manual Nick Thompson

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street